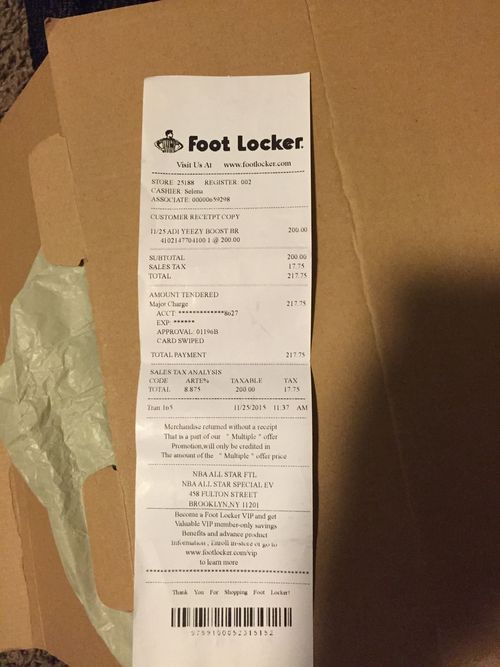

It's worth noting that Amazon announced in 2019 they would be required to collect tax on certain fees for sellers in certain states. It looks to me like this is referring to sellers in locations where electronic services may be taxable, which would mean taxes may be assessed on the fees sellers pay for eBay services.ĮBay sellers in other countries may already be accustomed to this situation with VAT and GST, but many US sellers will be surprised if they start seeing additional taxes on top of fees -especially smaller, consumer sellers.

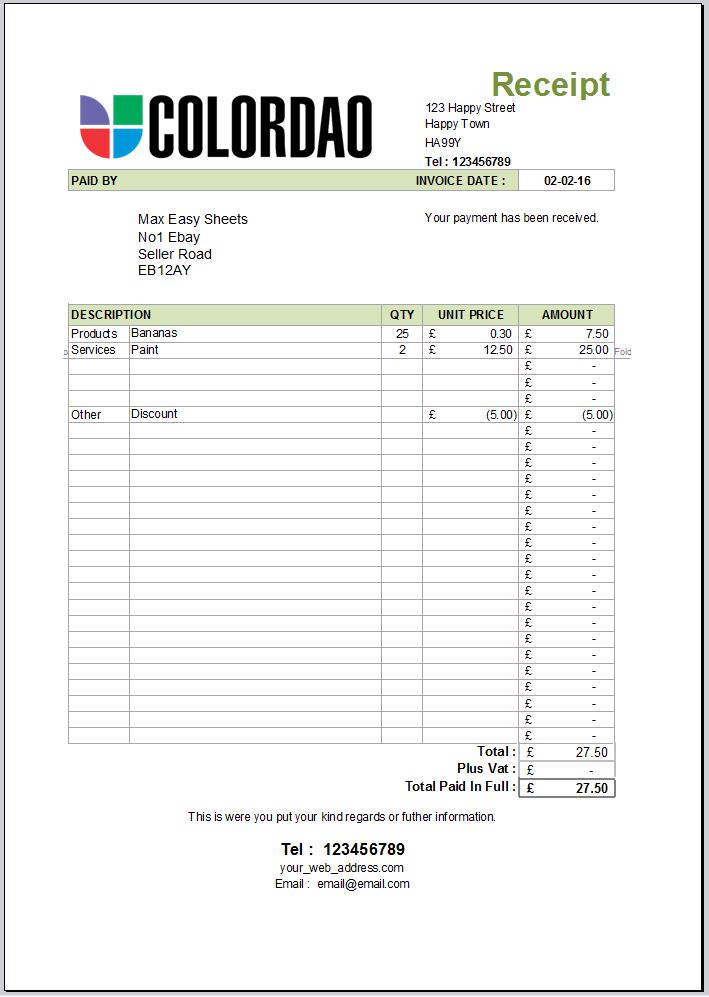

If you sell on multiple eBay sites, you'll see the fees and taxes grouped by currency. Your Tax invoice shows you the applicable taxes on fees already deducted from your Available, Processing, and On hold funds. Every month you'll receive an email to let you know your Tax invoice is available to download. The biggest confusion seems to be centered around eBay's use of the word "invoice." Several sellers pointed out "invoice" would denote a bill or that there is money owed but in this case it appears to be more of a report than an actual invoice.Īfter doing a little digging, I found this eBay help page that says Your Tax invoice is issued for services rendered and includes all applicable seller fees. Sellers enrolled in eBay's Managed Payments system are questioning a new report that eBay has rolled out. Liz Morton ~ Founder Published: Updated: Nov 13 2021

Ebay invoice full#

If your eBay business has provided an ABN to eBay as part of registering for eBay managing payments, we won't add GST to your eBay fees.įor full details on the fees charged on eBay, including dispute fees and additional fees for sellers who don’t meet minimum performance standards, visit our Help Hub.

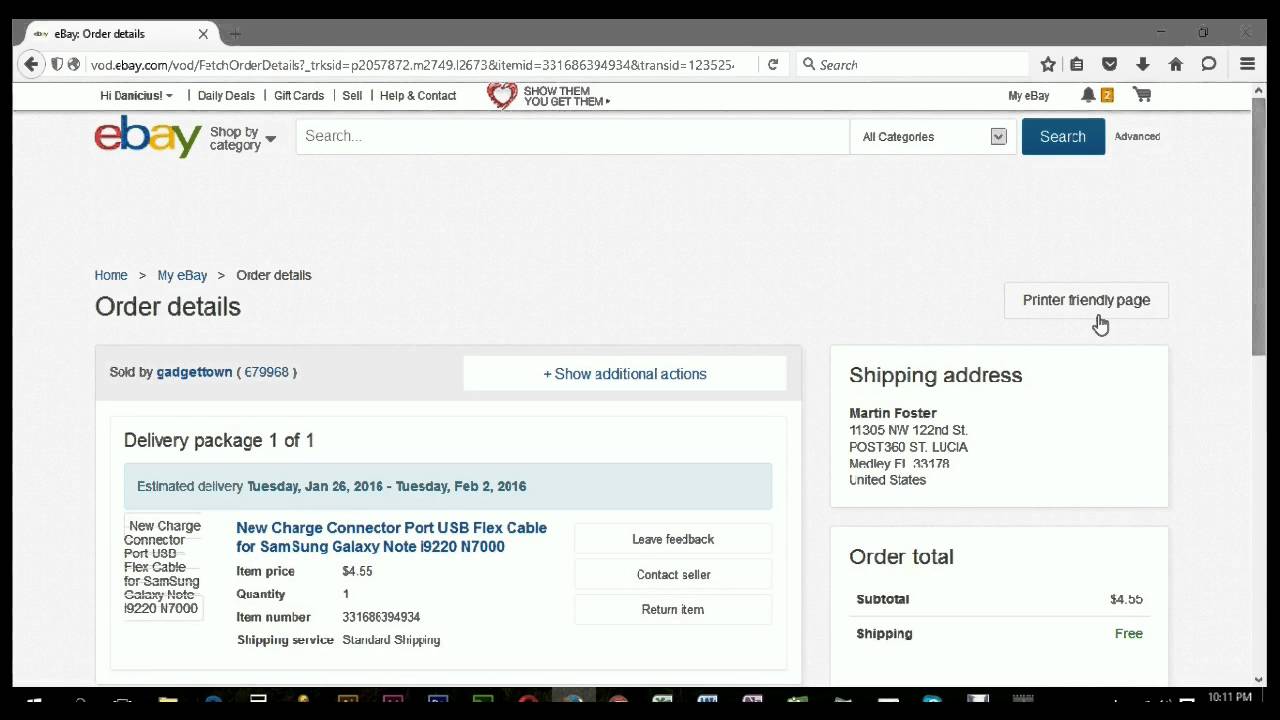

Ebay invoice registration#

Unless your eBay business has registered for eBay to manage your payments and has provided tax registration details (ABN) during registration, GST will be added to your eBay fees. If your registered address is in Australia, GST of 10% is payable on your eBay fees. GST) of the total amount of the sale (including postage and handling and any tax or other applicable fees) and is automatically deducted from your sales proceeds.

In this format, we'll charge an insertion fee when you create your listing. In the Real Estate and Services categories, you can list using our Classified Ad format. View the fees for selling motor vehicles on eBay. We charge an insertion fee when you create a Motors listing and a fixed final value fee when your vehicle sells. The fees for listing and selling a vehicle are different to those in other categories but the overall structure is the same.

0 kommentar(er)

0 kommentar(er)